Netflix Is Out to Conquer the World, and Goldman Thinks It Can

Filed under: Company News, Netflix, Entertainment Industry, Upgrades and Downgrades, Investing

Netflix’s (NFLX) overseas potential encouraged Goldman Sachs last week to upgrade its view of the leading premium video service from neutral to buy.

Netflix’s 35.67 million domestic streaming accounts as of the end of March comprise nearly a third of America’s households. But analyst Heath Terry — whose employer Goldman Sachs had been neutral since 2011 — feels that the real catalyst for the company’s growth rests in its international prospects. Terry is using that thesis to justify boosting his price target from $380 to $590.

It’s a Small World

Netflix has a presence in more than 40 countries, but it has just 12.68 million streaming accounts outside of the United States. That number has serious potential to grow.

Goldman Sachs sees the addressable international market for streaming video — the number of homes that have access to broadband to watch digital video at home — more than doubling over the next three years to 207 million potential accounts. If Netflix is able to nab 30 percent of those homes — in line with how it’s faring in America — that would be about 62 million international subscribers come 2017.

Netflix’s international operations are collectively running at a slight loss these days, but looking ahead, Terry predicts 20 percent margins for Netflix’s overseas business. It’s close to turning the corner of profitability outside of the U.S.; the company posted its smallest deficit this past quarter since expanding internationally in 2010. Netflix’s guidance predicts an even smaller loss for the quarter that ended in June. Overseas profitability will make it easier for Netflix to invest in more proprietary content geared to these other markets.

There’s a Map for That

Netflix debuted internationally in the fall of 2010 with Canada. It followed that up with dozens of Latin American and Caribbean nations before turning to Europe.

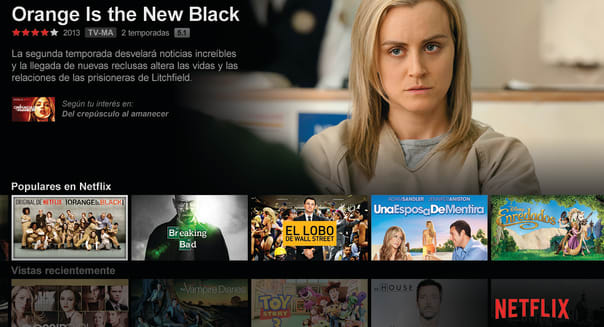

Netflix isn’t revealing how its 12.68 million international accounts break down by country, but it’s a safe bet that it lacks the kind of country-specific dominance that it has closer to home. It can’t justify the push for original programming like it did in the U.S. with “House of Cards” or “Orange Is the New Black” when it has to divide those costs by hundreds of thousands of subscribers instead of tens of millions.

Scalability is a big thing for Netflix, and the concept should continue to work in its favor despite the decision to increase monthly prices worldwide earlier this year. Netflix is making some country-specific additions to its growing digital library, and it is pushing into continental Europe later this year. The real treat awaits when Netflix has the world defaulting to the premium service as the platform of choice.

Motley Fool contributor Rick Munarriz owns shares of Netflix. The Motley Fool recommends Netflix. The Motley Fool owns shares of Netflix. Try any of our newsletter services free for 30 days.

Permalink | Email this | Linking Blogs | Comments

http://www.dailyfinance.com/on/netflix-overseas-growth-profits-goldman-outlook/